Classifying Your Workers Correctly

Your company must distinguish properly between employees and independent contractors under IRS common law tests and Idaho law. You should look at behavioral control, financial control, and the overall relationship to decide if a worker belongs on payroll or can be treated as a contractor.

Idaho generally follows federal guidance, but state agencies can audit your classifications for unemployment insurance and workers’ compensation. Misclassification can trigger back wages, unpaid overtime, tax assessments, penalties, and liability for unpaid premiums – review this guide to avoid issues: https://www.playroll.com/blog/employee-misclassification-guide.

Verify Employee Work Eligibility

You must complete federal Form I‑9 for every employee you hire in Idaho within 3 business days of the start date. Employees must present acceptable identity and work authorization documents from the Lists of Acceptable Documents, and you must physically review them or follow approved remote procedures.

Idaho does not mandate E‑Verify statewide, but some public employers and contractors may be required to use it by contract or local policy. You must retain I‑9s for at least 3 years after the hire date or 1 year after termination – whichever is later – and store them separately from general personnel files for easier audits.

Create an Employee Onboarding Process

When you hire in Idaho, you should issue a clear written offer letter that outlines pay rate, pay schedule, exempt or nonexempt status, and basic benefits. During onboarding, you will collect federal Form W‑4, any Idaho state withholding form if used, direct deposit details, and signed acknowledgments for your employee handbook and key policies.

Your company should also provide required notices such as workers’ compensation information and unemployment insurance contacts, and report new hires to the Idaho Department of Labor within 20 days. Building a consistent onboarding checklist helps you control compliance risk and gives you better visibility into the true cost of hiring in Idaho.

Pay Frequency & Methods

Idaho law allows you to pay employees monthly or more frequently, so many employers choose biweekly or semimonthly cycles for easier cash‑flow planning. If you terminate an employee, you must pay all final wages by the next regular payday or within 10 days of a written demand, and late payment can expose your company to wage claims and potential penalties.

Payment Methods (How You Can Pay)

You can choose from several payment methods in Idaho, but you must ensure employees receive full wages on time and get an accurate wage statement every pay period.

- Payroll Check: You may pay by paper check as long as employees can access full wages at face value without fees and you provide a detailed pay stub.

- Cash: You can pay in cash in Idaho, but you must keep precise records and give employees a written statement of hours, rates, and deductions each payday.

- Direct Deposit (EFT): You may use direct deposit, but it must be voluntary – you need the employee’s written consent and must offer an alternative if they decline.

- Paycards: You can use paycards if employees can access their full net wages at least once per pay period fee‑free and you clearly disclose all card terms.

- Outsourced Payroll: You may outsource payroll to a provider, but your company remains responsible for accurate wage payments, tax withholdings, and filings under Idaho law.

When choosing a method, you should consider employee preferences, banking access in rural Idaho areas, and how easily you can maintain records that support audits or wage disputes.

When you hire employees in Idaho, you must withhold and remit federal payroll taxes plus state income tax and unemployment insurance. Your company will need to register with the Idaho State Tax Commission and the Idaho Department of Labor before running payroll.

Employer Tax Contributions

As an Idaho employer, you are responsible for paying your share of Social Security and Medicare, federal and state unemployment insurance, and any required local contributions. You must obtain an Idaho withholding account number and an unemployment insurance account, then file returns and pay contributions on the schedules assigned by each agency.

Employee Payroll Tax Contributions

Your company must withhold federal income tax, Social Security, Medicare, and Idaho state income tax from employee wages. You are responsible for depositing these amounts on time and providing employees with Form W‑2 after year‑end.

Minimum Wage in Idaho

Idaho’s minimum wage is currently $7.25 per hour, matching the federal Fair Labor Standards Act rate. You must pay at least this amount to non‑exempt employees, with limited exceptions such as a lower training wage for certain youth workers under federal rules.

Working Hours in Idaho

Idaho does not set daily hour limits for most adult employees, so you can schedule as business needs require as long as you comply with overtime and safety laws. The state does not mandate meal or rest breaks, but if you choose to provide short rest breaks of 20 minutes or less, they must be paid under federal law.

Overtime in Idaho

Idaho follows federal overtime rules, requiring you to pay at least 1.5 times the regular rate for all hours worked over 40 in a workweek by non‑exempt employees. You should clearly define your workweek in writing and track all hours worked, including approved overtime and certain off‑the‑clock tasks, to avoid wage claims.

Idaho does not mandate many employer‑paid benefits beyond what federal law requires, so your company’s health, retirement, and paid leave offerings are key to staying competitive. If you average 50 or more full‑time employees in the U.S., the Affordable Care Act requires you to offer affordable, minimum‑value health coverage or face potential penalties.

Mandatory Leave Policies in Idaho

Paid Time Off in Idaho

Idaho does not require employers to provide paid vacation or general PTO, so you can design a policy that fits your budget and talent strategy. If you choose to offer PTO, you should clearly state accrual rates, carryover rules, and whether unused time is paid out at termination, and then follow that policy consistently.

Idaho law does not force PTO payout on separation unless your policy or contract promises it, but many employers pay out accrued balances to remain competitive and avoid disputes. Make sure your PTO policy coordinates with any unpaid leave rights under FMLA or disability accommodations.

Maternity & Paternity Leave in Idaho

Idaho does not have a separate state parental leave program, so maternity and paternity leave generally fall under federal FMLA for eligible employers and employees. If you have 50 or more employees, qualifying workers may take up to 12 weeks of unpaid, job‑protected leave for birth, adoption, or foster placement.

Your company can choose to offer paid parental leave or allow employees to use accrued PTO or sick leave during FMLA time. You should document eligibility, notice requirements, and how benefits such as health insurance continue during leave to avoid misunderstandings.

Sick Leave in Idaho

There is no statewide requirement for private employers in Idaho to provide paid sick leave. If you offer sick leave, your policy should define what qualifies as sick time, any waiting periods, and whether employees can use it for family members’ illnesses.

Even without a mandate, you must consider federal laws such as the Americans with Disabilities Act, which may require reasonable unpaid leave or schedule adjustments as an accommodation. Clear documentation and consistent administration of your sick leave policy help you manage both compliance and employee expectations.

Military Leave in Idaho

Employees in Idaho who serve in the U.S. armed forces or National Guard are protected by federal USERRA and state law. You must allow unpaid leave for qualifying service, maintain benefits as required, and reinstate employees to the same or an equivalent position when they return, subject to eligibility rules.

Your company cannot discriminate or retaliate against employees because of their military obligations. You should track military leave carefully and coordinate with your benefits providers to ensure proper continuation or reinstatement of coverage.

Jury Duty in Idaho

Idaho employers must allow employees to take time off to serve on a jury and may not threaten or discipline them for complying with a summons. State law does not require you to pay employees for this time, but you must let them keep any juror fees they receive unless a written policy says otherwise.

Many employers choose to provide some paid jury duty leave, especially for short service, to support civic participation. Whatever approach you take, document it in your handbook and apply it consistently.

Voting Leave in Idaho

Idaho law does not specifically require employers to provide paid or unpaid time off to vote. However, you should avoid scheduling practices that effectively prevent employees from reaching the polls during the state’s voting hours.

Offering flexible scheduling, shift swaps, or limited unpaid time off can help your workforce participate in elections without disrupting operations. Clearly communicating your expectations before election days reduces confusion and last‑minute requests.

Bereavement Leave in Idaho

Idaho does not mandate bereavement leave, so whether time off is paid or unpaid is up to your company’s policy. Many Idaho employers provide 1–3 days of paid leave for the death of an immediate family member as a competitive practice.

Because grief can affect performance and attendance, you may also want to allow employees to use PTO or unpaid leave beyond any standard bereavement allotment. Make sure your policy defines eligible relationships and required documentation, and train managers to apply it with sensitivity.

Termination Process

Idaho is an at‑will employment state, meaning you can generally terminate employment at any time for any lawful reason, provided you do not violate anti‑discrimination or retaliation laws or breach a contract. You should document performance issues, policy violations, and prior warnings to reduce the risk of wrongful termination claims.

Notice Period

Idaho law does not require employers or employees to give advance notice before ending employment, unless a contract or collective bargaining agreement says otherwise. Even though notice is not mandated, providing some lead time or pay in lieu of notice can ease transitions and protect your company’s reputation.

Severance

Severance pay is not required under Idaho law, but you may choose to offer it in layoffs or negotiated separations. If you provide severance, you should put the terms in a written agreement that addresses payment timing, benefits continuation, and any release of claims, and then apply your severance practices consistently.

How do you set up payroll processing in Idaho?

.png)

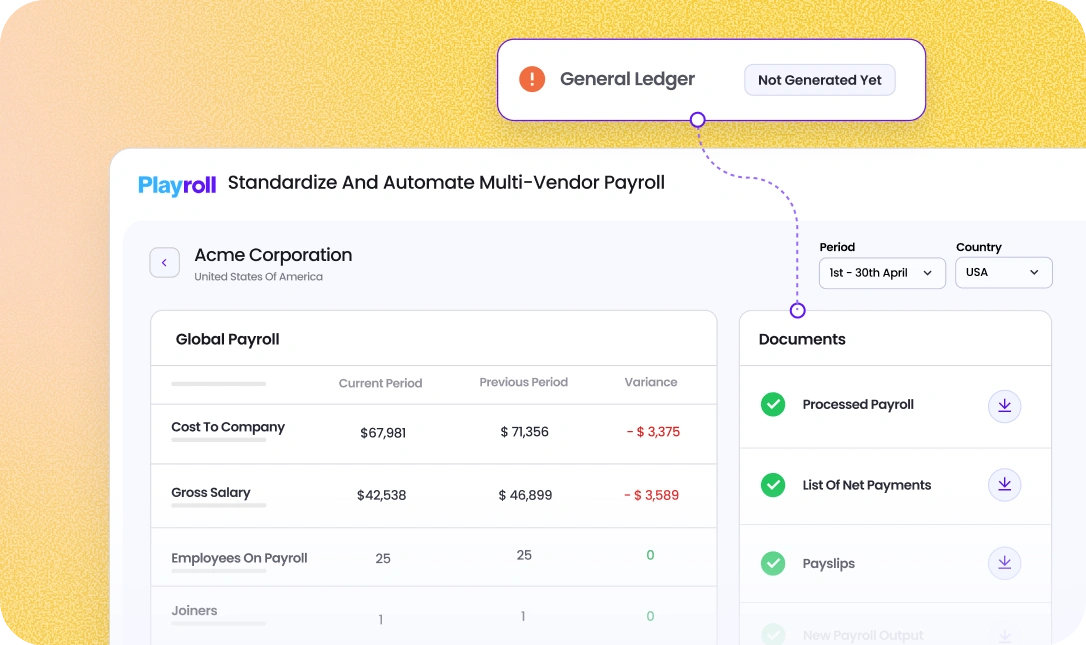

To set up payroll processing in Idaho, you first need to obtain a federal EIN, then register for an Idaho withholding account with the Idaho State Tax Commission and an unemployment insurance account with the Idaho Department of Labor. After registration, you should choose a pay frequency that complies with Idaho’s allowance of at least monthly pay, implement a system to track hours and calculate wages, withhold federal and Idaho income taxes plus FICA, and file and deposit all taxes on the schedules assigned by each agency while keeping detailed payroll records for several years.

How does an Employer of Record help you hire in Idaho?

.png)

An Employer of Record helps you hire in Idaho by acting as the legal employer for tax and compliance purposes while you manage the employee’s day‑to‑day work. The provider handles Idaho registrations, payroll, tax withholdings, workers’ compensation, unemployment insurance, and locally compliant contracts and benefits, so you can onboard staff quickly without creating your own Idaho entity or building in‑house HR infrastructure.

Is there a minimum wage requirement for employees in Idaho?

.png)

Yes, there is a minimum wage requirement for employees in Idaho, and it currently matches the federal rate of $7.25 per hour for most non‑exempt workers. Your company must pay at least this amount, follow federal rules on tipped employees and youth wages, and also ensure that overtime is paid at 1.5 times the regular rate for hours over 40 in a workweek.

How much does it cost to employ someone in Idaho?

.png)

The cost to employ someone in Idaho includes more than just the employee’s hourly wage or salary – you also need to budget for the employer share of Social Security and Medicare, federal and Idaho unemployment insurance contributions, workers’ compensation premiums, and any health, retirement, or paid leave benefits you choose to offer. Depending on your benefit strategy and industry risk level, your total employer cost in Idaho can easily run 15–30 percent or more above the employee’s gross pay.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)