What Are Payroll Costs? A Complete Breakdown

Every employee you hire carries more cost than just their base salary. To run payroll correctly (and avoid surprising cost hikes) you need to understand three layers of payroll costs: direct, indirect, and hidden costs. When you combine them, especially in different countries, total payroll expenses can shift dramatically.

Direct Payroll Costs

For every business – whether a startup hiring its first contractor or an enterprise paying thousands to build up your engineering department – direct payroll costs form the foundation of total expenses. These are the unavoidable payments that make up the bulk of your payroll budget, and they scale in direct proportion to your headcount. These employee costs are the numbers you typically plan for first:

- Gross wages, salaries, bonuses

- Overtime payments, commissions

- Pay for hours worked in each pay period

Indirect Payroll Costs

Indirect costs often take founders and SMBs by surprise because they don’t show up in a job offer letter, but they can rival or even exceed direct salaries. For larger enterprises, these obligations multiply across geographies, making them one of the hardest costs to forecast and control.

- Employer’s portion of taxes (e.g. FICA in the U.S., or equivalent social security, pension, health insurance contributions in other countries)

- Benefits like health insurance, retirement or pension contributions, paid time off (PTO)

- Vacation, sick leave, parental leave

Hidden Costs in Payroll

These are the expenses that drain time and cash without being obvious. For startups, hidden costs eat into already tight budgets; for SMBs, they create friction that slows growth; and for enterprises, they compound into millions in unplanned outlay and wasted hours.

- Compliance costs include fees related to legal, local labor law, tax filing, or audits

- Currency conversion fees (for international hires) and cross‐border payments

- Administrative time and costs to manage time tracking, software, corrections, onboarding, or handling employee tax forms

U.S. vs. International: Employer Tax & Social Security Comparison

To illustrate how much payroll costs can vary, here’s a comparison of employer payroll tax burdens across several countries.

Note: These are approximate employer social security/employment tax burdens. Actual cost can vary based on salary levels, benefits, industry, and local regulations.

How Much Do Payroll Services Cost?

Payroll service providers charge in different ways (base fees, per‐employee fees, service tiers), so costs vary a lot depending on your business size, location, and complexity.

As a rough benchmark: a small business (~10-30 employees) can expect to pay US$175–US$300/month for full payroll services. For larger firms with many employees or international operations, that can rise to several thousand dollars per month.

Factors That Impact Payroll Costs

As we’ve seen, there are several dimensions to payroll – each of which has a different effect on your total payroll cost. But let’s take a look at the major levers that drive how much you’ll actually pay and where costs tend to escalate, especially for global expansion.

Business Size / Location

- Headcount: Larger headcounts naturally drive higher total payroll expenses, but many providers lower the per-employee fee as you scale, creating economies of scale.

- Location: Each country sets its own rules for taxes, minimum wage, and social benefits. For example, in Brazil, employers must cover both a national minimum wage and mandatory benefits like paid holiday and a 13th-month salary, which makes payroll significantly more expensive than in markets like the U.S.

Pay Frequency

- Pay Cycles: How often you run payroll (weekly, biweekly, or monthly) affects both direct provider fees and administrative workload. More frequent cycles usually mean higher processing costs and more room for error.

- Local Rules: Some countries set overtime and benefits accruals based on weekly calculations, while others use monthly periods. These differences can influence how much you pay in both payroll service fees and employee entitlements.

Compliance Regulations

- Local Obligations: Governments require employers to meet minimum wage standards, pay into social security systems, honor statutory leave, and follow local tax filing rules. Each obligation comes with its own cost.

- Penalties: Errors or late filings can lead to fines, interest, or reputational damage. For startups with small teams, even a minor compliance mistake can inflate your overall payroll costs.

Currency Fluctuations & Cross-Border Costs

- Conversions: Paying employees in multiple currencies introduces conversion fees and exposes your payroll to exchange rate volatility. Even a 1–2% swing in FX rates can change your monthly payroll bill.

- Transfers: International payments often involve additional bank fees, intermediary charges, and delays, which not only increase costs but also create cash flow challenges.

Global Factors

- Mandatory Benefits: Some countries require employers to provide benefits beyond base pay. In much of Latin America, a 13th-month salary (aguinaldo) is mandatory, effectively adding another month of wages per year.

- Additional Entitlements: Minimum wage differences, mandatory pension contributions, state health insurance, and even transport stipends can all increase costs. What seems like a low salary market at first glance may come with expensive employer obligations.

How to Accurately Calculate Payroll Costs

Calculating payroll costs across multiple countries can feel overwhelming. The best way to stay in control is to break the process into clear steps, while also being aware of the most common pitfalls at each stage. Here’s how to do it:

1. Start with Direct Pay

List every employee’s base salary, bonuses, commissions, and overtime. Normalize this data into monthly or per-pay-period amounts so it’s consistent across your team.

- Common Mistake: Many businesses forget to factor in variable pay like commissions or bonuses when modeling payroll, which makes actual expenses look higher than forecasts.

- How to Avoid It: Always include both fixed and variable pay elements in your baseline calculation.

2. Add Employer Taxes and Social Contributions

For each country, apply the correct employer-side taxes (e.g., U.S. FICA at 7.65%, or social security contributions in Europe that can reach 25–30%).

- Common Mistake: Treating employee withholdings as employer costs, or missing thresholds and caps entirely.

- How to Avoid It: Separate employer vs. employee obligations, and always check for wage bases or contribution ceilings.

3. Layer in Statutory Benefits

Include mandatory benefits like pensions, health insurance, paid leave, or 13th-month salary in Latin America. These can add 10–20% or more to your payroll cost.

- Common Mistake: Overlooking mandatory extras like 13th-month pay, which can lead to sudden year-end cost spikes.

- How to Avoid It: Accrue the cost each month (e.g., add 1/12 of salary to your monthly budget) so there are no surprises.

4. Account for Payroll Services and Software Fees

Add your provider’s costs, whether that’s a flat monthly fee, per-employee-per-month (PEPM) pricing, or extra charges for filings and tax forms.

- Common Mistake: Businesses often budget only for direct pay and taxes, forgetting recurring payroll services fees or hidden admin charges.

- How to Avoid It: Review your provider’s pricing model in detail and include base and per-employee costs in your calculation.

5. Factor in Currency and Cross-Border Payments

If you’re paying employees in multiple currencies, include conversion fees, banking charges, and FX volatility. Even small swings can add up.

- Common Mistake: Using spot exchange rates and ignoring provider spreads or transfer fees.

- How to Avoid It: Budget using a “landed FX rate” (mid-market + spread) and stress test ±2–5% to see how payroll costs shift.

6. Include Compliance and Admin Time

Consider the internal time your HR or finance team spends on payroll. Hours spent filing forms, correcting errors, or dealing with audits translate directly into costs.

- Common Mistake: Treating internal time as “free.” In reality, every hour spent processing payroll is time not spent on growth.

- How to Avoid It: Assign a real cost to admin hours (fully loaded hourly rate) and compare it to the cost of outsourcing.

7. Plan for Onboarding, Offboarding, and One-Off Costs

Factor in expenses like work permits, equipment, severance, and PTO payouts. These don’t hit every month, but they add up across a year.

- Common Mistake: Ignoring one-off costs until they appear, which throws off cash flow.

- How to Avoid It: Spread these costs across the expected tenure of employees to keep payroll forecasts realistic.

8. Build in a Contingency Buffer

Even with careful planning, payroll costs fluctuate due to compliance changes, FX movements, or benefit adjustments.

- Common Mistake: Budgeting down to the last dollar.

- How to Avoid It: Add a 3–5% contingency buffer to your total payroll cost so you can absorb surprises without derailing growth plans.

Strategies to Reduce Payroll Costs Without Compromising Quality

Payroll will always be one of your largest expenses, but there are smart ways to manage it without cutting corners or losing talent. The key is to focus on efficiency, compliance, and global strategy.

Automate Payroll with an EOR

Manual payroll processes create errors, drain HR bandwidth, and increase compliance risk. By working with an EOR, you can automate cross-border payroll reconciliation and compliance checks in one, intuitive system. This will reduce your admin overhead and completely eliminate the need for local entities in every country.

For startups, this can drastically cut payroll processing time down and free leadership to focus on growth.

Negotiate Benefits Globally

Benefits packages are a major indirect payroll cost, but they don’t have to be static. Many global benefits providers allow you to pool purchasing power across multiple countries, giving you lower rates on health, retirement, and wellness programs. Even large enterprises can reduce benefit spend by standardizing offerings regionally instead of negotiating country by country.

Leverage Tax Incentives

Governments worldwide offer payroll-related incentives, especially around R&D. For example, the U.S. and U.K. both provide tax credits for research and development expenditures, which can offset part of your payroll tax burden for eligible employees. By mapping where your teams work against available incentives, you can strategically position talent to capture those savings.

Hire in Cost-Effective Regions

Talent quality doesn’t always match cost. By building remote teams in cost-effective hiring markets, you can reduce payroll costs dramatically without sacrificing skill. Take for example India, where hiring savings can reach up to 60%, especially for junior to mid-level positions (before counting additional employer-side costs like benefits, taxes, and compliance).

The key is to hire where the skills are strong and the cost of living is lower, while still offering competitive local packages.

How to Choose Payroll Software to Save Costs

Think of choosing payroll software like peeling an onion: each layer reveals another factor you need to consider. Work through them one by one, and you’ll avoid hidden fees while finding a solution that fits your business.

- Step 1: Consider Company Size & Set-Up

Start with the core: your headcount, growth trajectory, and where your employees are located. A tool that works for 10 people in one country may collapse under the weight of 100 employees across five regions. - Step 2: Check Your Budget

Peel back the sticker price to see the whole picture. Look beyond monthly fees to include per-employee charges, implementation, filings, and year-end forms. Only then do you know your real cost. - Step 3: Map Out Your Payroll Needs

This layer reveals what you actually need the software to do domestic vs. global payroll, tax filing, benefits, contractors, multi-currency support. The more features, the higher the cost, so be sure you’re not paying for extras you won’t use yet. - Step 4: Do You Need Internal Expertise?

Not every team has in-house payroll or compliance specialists. If you don’t, you’ll need software that carries more of the compliance burden – or an EOR solution that removes it entirely. - Step 5: Choose Between Total Control and Outsourcing

At this layer, ask yourself: how much control do you want? Running payroll in-house gives you oversight, but it also adds risk and admin. Outsourcing to an EOR may cost less in the long run by cutting compliance and setup overhead. - Step 6: Factor in Cost of Ownership

The outer layer is the one most often missed: the “all-in” cost. Add up software fees, FX spreads, payment charges, and the internal time your team spends. A slightly higher software fee may save more once you factor in reduced admin hours.

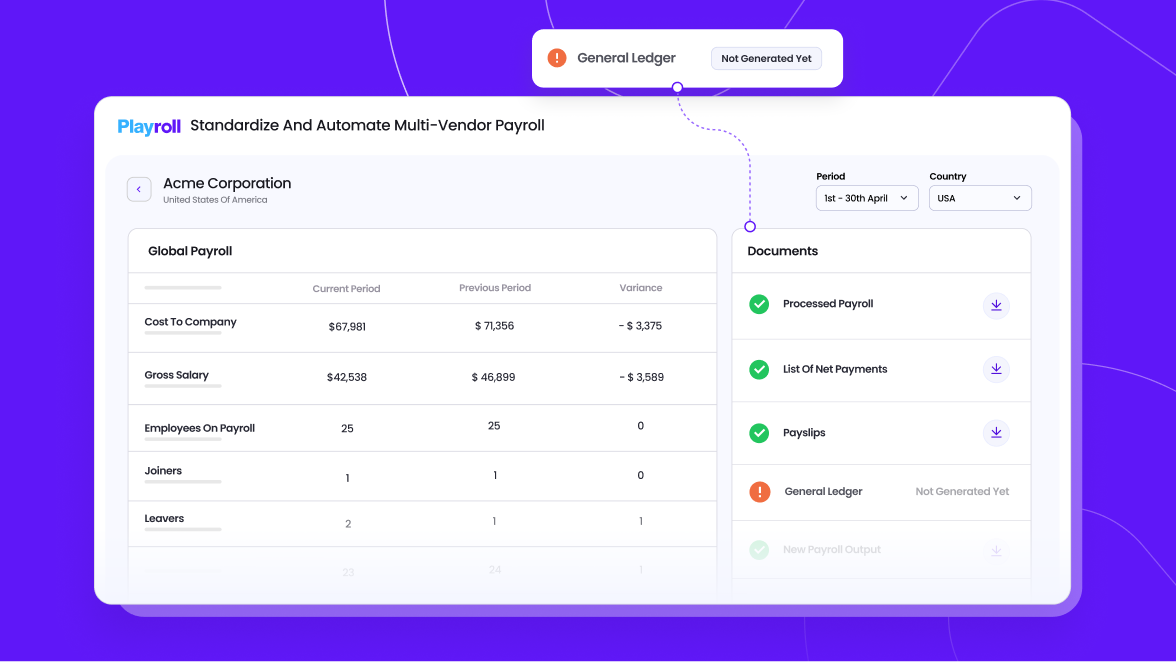

Manage and Optimize Payroll Costs with Playroll

Managing payroll costs in a single country is already complex. Add global expansion into the mix, and the challenge multiplies. Suddenly, you’re not just dealing with salaries, but also navigating local labor laws, mandatory benefits, social security contributions, tax regulations, banking fees, and fluctuating exchange rates.

So how can growing businesses gain clarity and control over payroll costs across borders? The answer lies in choosing a payroll solution designed for international scale.

That’s exactly what we’ve built at Playroll: a system that helps employers set accurate budgets, avoid costly errors, and pay global teams correctly and on time, every time. Want to see it in action? Schedule a chat with our team today to get started.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg) Back

Back

.svg)

.svg)

.svg)

.svg)

.svg)

.png)

.png)

.png)

.png)

.png)

.svg)

.svg)

.svg)

.svg)

.svg)