Who Is Entitled to Employee Benefits In Germany

In Germany, employee benefits are a fundamental aspect of the employment landscape, designed to ensure the well-being and security of workers. Both full-time and part-time employees are entitled to a range of mandatory benefits, with eligibility and scope often determined by factors such as employment status and duration of service.

German labor laws mandate that all employees, regardless of their working hours, receive certain core benefits. However, the extent of these benefits can vary. For instance, while full-time employees typically receive the full spectrum of benefits, part-time employees' entitlements are proportional to their working hours. Additionally, certain benefits may require a minimum period of employment; for example, eligibility for paid sick leave often necessitates continuous employment for a specified duration.

Overview of Employee Benefits In Germany

Employee benefits in Germany are comprehensive and reflect the country's commitment to worker welfare. Compared to other nations, Germany offers generous statutory benefits, including extensive health insurance coverage, substantial parental leave, and robust pension schemes. These benefits are deeply ingrained in the workplace culture, underscoring a societal emphasis on balancing work and personal life, and ensuring long-term security for employees.

Mandatory Employee Benefits in Germany

Mandatory benefits are legally required and form the core of any employee benefits package in Germany. Here’s a comprehensive list of mandatory benefits in Germany:

Health Insurance

In Germany, health insurance is mandatory for all employees. Employees earning below a certain income threshold are automatically enrolled in the statutory health insurance system (Gesetzliche Krankenversicherung or GKV), which is funded through contributions shared equally between employers and employees, typically amounting to 14.6% of the employee’s gross monthly salary. This system ensures access to comprehensive medical care, including doctor visits, hospital stays, and prescription medications. Employees who earn above €64,350 annually have the option to choose private health insurance (Private Krankenversicherung or PKV), which may offer additional benefits.

Pension Insurance

Germany's pension system operates on a pay-as-you-go model, providing financial support to employees upon retirement. Both employers and employees contribute equally to the statutory pension insurance scheme, ensuring income security in old age. The standard retirement age is gradually increasing to 67 by 2031, with incentives in place to encourage longer workforce participation.

Unemployment Insurance

Unemployment insurance offers financial assistance to employees who lose their jobs. This system provides a safety net, allowing individuals to seek new employment opportunities without immediate financial strain. Employees working at least 18 hours a week are eligible for unemployment insurance, covering approximately 2.6% of their salary. This is also split between employer and employee contributions (each paying around 1.3% of the employee's gross monthly salary).To qualify for unemployment benefits, an individual must have contributed to unemployment insurance for at least 12 months within the last 24 months before losing their job.

Long-Term Care Insurance

Long-term care insurance (Pflegeversicherung) supports individuals who require assistance with daily activities due to age or health conditions. Contributions around 3.05% are divided equally between employers and employees. This insurance ensures that employees have access to necessary care services, enhancing their quality of life during periods of dependency.

Accident Insurance

Accident insurance covers work-related accidents and occupational illnesses. Employers bear the full cost of this insurance, which provides benefits such as medical treatment, rehabilitation, and compensation for lost wages. This ensures that employees receive prompt and adequate support in the event of workplace incidents. Rates vary depending on the industry and the level of risk associated with the job

Annual Leave

In Germany, annual leave is a mandatory benefit regulated by the Federal Holiday Act (Bundesurlaubsgesetz). This act sets a minimum entitlement of 20 paid days per year for employees working a five-day week. This minimum requirement can often be extended, with many employers offering up to 30 days to stay competitive and meet employee expectations.

Maternity and Parental Leave

Germany offers generous maternity and parental leave policies. Maternity leave, or Mutterschutz, includes 14 weeks of paid leave—6 weeks before the expected due date and 8 weeks after childbirth. Postnatal leave is extended to 12 weeks for cases involving multiple or premature births.

During maternity leave, mothers are entitled to their full salary. Health insurance covers a portion of this (up to €13 per day), while the employer tops up the difference to match the mother’s average net earnings over the last three months.

German law provides robust job security during maternity leave. From the beginning of pregnancy until four months after childbirth, mothers are protected against termination, and employers must hold their positions open, enabling them to return to the same role or an equivalent one

Beyond maternity leave, German parents can also take up to three years of parental leave per child. This period can be split between both parents or taken by just one and can be taken continuously or in segments.

Parents can also reserve up to 24 months of their leave to be used anytime before the child’s eighth birthday. Although parental leave itself is unpaid, parents can apply for a government-funded parental allowance (Elterngeld).

Supplemental Employee Benefits in Germany

Supplemental benefits are not required by law, but can help you stand out as an employer and attract top talent. They include:

Private or Supplemental Health Insurance

In Germany, private health insurance or private Krankenversicherung (PKV) is an alternative to public health insurance, available mainly to high-income employees, self-employed individuals, and civil servants. PKV offers enhanced benefits which are often limited in public insurance. Premiums for private insurance depend on age, health, and coverage level rather than income. Additionally, public health-insured employees can add supplemental private plans to cover gaps in standard public health benefits.

These plans may include additional services such as enhanced dental care, alternative treatments, or private hospital rooms, thereby increasing employee satisfaction and well-being.

Additional Retirement Plans

In Germany, private retirement plans are a popular supplement to the public pension system, as they provide additional financial security for retirement to employees. While public pensions offer reliability, they may be insufficient for a higher retirement standard. This is where private pension plans come in. They allow for more investment flexibility and personalized retirement income options, such as lump-sum withdrawals or structured payouts.

Offering both private and public pension systems to employees provides a balanced retirement approach, combining stable public pensions with the customizable benefits of private plans.

Gym Memberships and Wellness Programs

Promoting health and wellness, some employers offer benefits like gym memberships, wellness programs, or health workshops. These initiatives encourage a healthy lifestyle, reduce stress, and can lead to increased productivity and reduced absenteeism.

Additional Paid Time Off (PTO)

While Germany mandates 20 days of leave, companies often increase this to around 30 days, which is a valued perk for employees in a competitive job market. In Germany, additional paid time off (PTO) goes beyond standard annual leave, offering various forms of leave for significant life events and special circumstances. The most common additional PTO options include extra vacation days, sabbaticals, mental health days, special occasion leave, compassionate leave, and religious leave. These PTO policies help employees balance work and personal life and help support family and personal well-being in the workplace.

Transportation and Commuting Support

To ease the burden of lengthy daily commutes, some employers provide transportation allowances, subsidies for public transit passes, company cars or bike leases. This support not only reduces employees' commuting expenses but also promotes punctuality and reduces stress associated with travel. Additionally, encouraging the use of public transportation aligns with environmental sustainability efforts.

Flexible Work Arrangements

Hybrid work options, allowing employees to work remotely for part of the week, have become a popular supplemental benefit since the pandemic. Additionally, employers can allow workers to work abroad for a few weeks during the year. This is usually within the European Economic Area (EEA), to avoid tax and labor complications.

These supplementary benefits help employers stand out by boosting employee satisfaction and well-being beyond Germany’s statutory requirements.

Additional Subsidies

Employers may offer various subsidies, such as meal allowances, wellness stipends, or professional development funds. These benefits support employees' health, well-being, and career growth, contributing to overall job satisfaction. Providing such subsidies can also enhance an organization's reputation as a desirable place to work.

In summary, Germany mandates a robust set of employee benefits, including health insurance, pension schemes, unemployment insurance, and generous leave policies, all designed to ensure the welfare and security of its workforce. To attract and retain top talent, many employers also offer supplemental benefits such as private health insurance options, additional retirement plans, wellness programs, and flexible working arrangements. Understanding and complying

Tax Implications of Employee Benefits in Germany

Employee benefits in Germany are subject to specific tax regulations. Mandatory benefits, such as health insurance and pension contributions, are typically exempt from taxation. However, supplemental benefits, like bonuses, are generally considered taxable income.

How to Offer an Employee Benefits Program for Employees in Germany

Set Budget & Goals

Begin by defining clear objectives for your employee benefits program. For example, you might want to boost employee satisfaction, improve retention rates or attract top talent globally. Now, establish a realistic budget that aligns with these goals, taking into account the financial implications of offering various benefits across different regions.

Use tools like Playroll’s employee cost calculator to benchmark your offering across regions.

Partner with Benefits Providers

Collaborate with reputable global benefits providers who have proven experience in international markets. These partners can ensure compliance, and offer insights into local regulations, cultural expectations as well as competitive standards – making your benefits program more attractive to employees in each country.

Customize Benefits for Local Culture and Expectations

Employee needs and preferences can vary significantly across cultures. That’s why it’s so important to tailor your benefits offerings to reflect local customs, values, and expectations. For instance, while flexible work arrangements might be highly valued in one country, healthcare benefits could be more critical in another. Customizing your benefits packages accordingly can help make your offering more competitive to local talent.

Playroll’s benefits team provides expert insights into tailoring your benefits packages in 180+ regions to local needs, helping to attract and retain top talent.

Communicate the Benefits Program to Employees

Good communication is crucial to ensure employees understand and make use of the benefits available to them. Use appropriate messaging channels to inform employees about the program's details, how to access benefits, and any relevant procedures.

Encourage open lines of communication within the organization, and update the team on any changes in the benefits program. It’s a good idea to conduct regular employee engagement surveys to get feedback on satisfaction with your benefits program, to make proactive changes as needed.

Legal Considerations for Employee Benefits in Germany

German labor laws, primarily outlined in the Social Code (Sozialgesetzbuch), govern employee benefits. Employers are legally obligated to provide mandatory benefits, including health insurance and paid leave. Failure to comply can result in penalties.

How Benefits Impact Employee Cost

Employee benefits significantly influence overall payroll costs for employers in Germany. Mandatory contributions represent a substantial portion of employment expenses, but offering benefits can enhance retention and productivity.

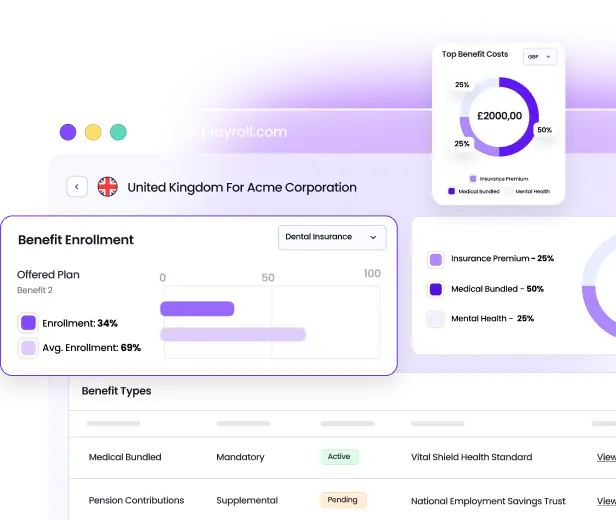

How Can Playroll Help with Benefits Management in Germany?

Managing employee benefits across multiple countries can be complex, but it doesn’t have to be. Playroll simplifies the process by handling administrative tasks, ensuring compliance with local regulations, and providing access to tailored benefits packages in 180+ regions.

With everything managed through a single platform, companies can focus on supporting their teams – wherever they are.

- Pick and choose from localized benefits packages to attract and retain global talent.

- Built-in compliance to stay ahead of evolving regulations.

- Manage leave, expenses, and more, through one intuitive dashboard.

Disclaimer

THIS CONTENT IS FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE LEGAL OR TAX ADVICE. You should always consult with and rely on your own legal and/or tax advisor(s). Playroll does not provide legal or tax advice. The information is general and not tailored to a specific company or workforce and does not reflect Playroll’s product delivery in any given jurisdiction. Playroll makes no representations or warranties concerning the accuracy, completeness, or timeliness of this information and shall have no liability arising out of or in connection with it, including any loss caused by use of, or reliance on, the information.

.svg)

.svg)

.svg)

.svg)

.png)

.webp)

.svg)