Who Is Entitled to Employee Benefits In Mexico

In Mexico, employee benefits are regulated by the Federal Labor Law (Ley Federal del Trabajo), which ensures that all workers, regardless of their employment status, are entitled to specific benefits. Full-time employees are guaranteed benefits, while part-time and temporary workers may have reduced entitlements based on their contracts. Independent contractors and freelancers typically do not qualify for the same statutory benefits as formal employees.

Employers are legally required to provide benefits to all eligible employees. These include workers on permanent contracts as well as those under temporary agreements, provided they meet specific working hour and duration thresholds defined by the law. The scope of benefits may also depend on factors like industry regulations and collective bargaining agreements.

Overview of Employee Benefits In Mexico

Employee benefits in Mexico are robust compared to many countries, reflecting the country’s commitment to social security and worker well-being. Employee benefits play a significant role in workplace culture, often serving as a key factor in employee satisfaction and retention. They ensure workers have access to health care, social security, and other essential services.

Mandatory Employee Benefits In Mexico

Mandatory benefits are legally required and form the core of any employee benefits package in Mexico. Here’s a comprehensive list of mandatory benefits in Mexico:

Social Security (IMSS)

In Mexico, social security contributions fund benefits like healthcare, disability, life insurance, pensions, unemployment support, and childcare through the Mexican Social Security Institute (Instituto Mexicano del Seguro Social or IMSS).

Employers contribute about 20-35% of an employee’s salary depending on the benefits covered, the employee’s tax bracket, and the industry’s risk category, while employees pay around 2.375%. Contributions are based on the Integrated Daily Salary (Salario Base de Cotización or SBC ) and include funding for retirement accounts (Administradoras de Fondos para el Retiro or AFOREs).

Employers must register employees with the IMSS and make monthly payments. Non-compliance leads to penalties and legal action.

Mandatory Christmas Bonus (Aguinaldo)

The Aguinaldo (Christmas Bonus) in Mexico is a mandatory year-end bonus required by law. Employees are entitled to a minimum of 15 days' salary, which must be paid by December 20th each year. The bonus is proportional for those who work less than a full year. It applies to all employees, including full-time, part-time, and temporary workers.

The bonus is subject to income tax, but at a lower rate – the first 30 days of the bonus are exempt from tax. The Aguinaldo helps workers cover holiday expenses and is a key part of Mexico's labor benefits.

Paid Vacation & Vacation Premium

Employees are entitled to paid vacation after their first year, starting at 12 days and increasing with tenure. In addition, they receive a vacation premium of at least 25% of their regular salary during vacation time.

Profit-Sharing (PTU)

Profit Sharing (Participación de los Trabajadores en las Utilidades or PTU) in Mexico requires companies to distribute 10% of their annual taxable profits to employees. This is mandatory for all companies, except those with no profits or specific exemptions like small businesses. PTU is divided into two parts: 50% is distributed equally among employees, and 50% is based on salary and days worked (the number of working days during the year).

Employers must pay PTU by May 31st of the following year or within 60 days of filing their taxes. PTU is taxed at a lower rate than regular income and is subject to the progressive income tax system, with rates ranging from 1.92% to 35% based on total taxable income. The benefit encourages employee engagement and motivates workers by sharing in the company's success.

Retirement Savings (SAR & AFORE)

Employers contribute to employees' retirement funds, managed by private pension institutions (AFORE). These savings ensure financial security for workers after retirement.

Maternity & Paternity Leave

In Mexico, female employees are entitled to 12 weeks of maternity leave – 6 weeks before the expected delivery date and 6 weeks after childbirth to allow the mother to recover and bond with the baby. Employees who adopt a child are also entitled to 6 weeks of paid leave, which begins when the child is legally placed in the adoptive parent's care.

If the mother experiences complications during childbirth or develops a serious health condition related to pregnancy, the IMSS may extend the maternity leave for up to 4 additional weeks. The employee will continue to receive full salary during this extended period, provided the condition is certified by a doctor. Upon returning from maternity leave, the employee is entitled to return to the position she held before she took maternity leave. Alternatively, she can take up an equivalent position with the same pay and benefits.

During maternity leave, women are entitled to receive 100% of their regular salary, which is paid through the IMSS. To qualify for this benefit, the employee must be registered with the IMSS and have made sufficient contributions. The amount paid is based on the salary registered with IMSS, and it may differ from the actual salary if some additional benefits are not included in the calculation reported to IMSS.

Paternity leave is a benefit provided to fathers after the birth of their child. While not as extensive as maternity leave, paternity leave is a legal right under the Federal Labor Law and provides fathers with time to support the mother and care for their newborn child. Under Mexican law, fathers are entitled to 5 days of paid paternity leave following the birth of their child. This leave is granted to fathers regardless of their marital status or whether they are the biological parent. Paternity leave must be taken immediately after the birth of the child. It cannot be postponed or extended unless the employer agrees to additional time off.

Severance Pay

In cases of unjustified termination, employees are entitled to severance, which may include three months' salary plus additional compensation based on tenure. This provides financial stability during job transitions.

Supplemental Employee Benefits In Mexico

Supplemental benefits are not required by law, but can help you stand out as an employer and attract top talent. They include:

Private Health Insurance

Private health insurance in Mexico provides additional coverage and access to private healthcare services, supplementing the public options available through the Mexican Social Security Institute (IMSS) or Instituto de Salud para el Bienestar (INSABI). While public healthcare offers basic medical services, private insurance gives individuals the option to receive faster, higher-quality care at private hospitals and clinics, with a wider selection of specialists and medical facilities.

There are various types of private health insurance plans. These plans can be purchased individually, for families, or through group coverage provided by employers. The cost of private insurance varies depending on the level of coverage, the individual's age, and health conditions.

In Mexico, private health insurance plans can be tailored to individual or family needs and are an attractive option for those seeking faster and higher-quality healthcare, either as a supplement to public health coverage or as a comprehensive standalone solution.

Life Insurance

Life insurance is an important employee benefit that provides financial security to employees and their families in case of death or permanent disability. Typically offered as group life insurance, these policies are often funded by employers and may cover death, disability, and in some cases, accidental death.

Employers may also offer employees the option to purchase additional coverage at discounted rates. Life insurance is generally tax-free for the employee and can be an attractive part of a compensation package, especially in high-risk industries.

Savings Funds (Fondo de Ahorro)

Savings funds are a common employee benefit designed to help workers build financial security through regular contributions, typically from both employers and employees. These funds are often part of broader employee benefits packages that aim to encourage long-term savings and provide a safety net for workers.

Savings funds in Mexico can take various forms, and their structure depends on the type of plan offered by the employer, with the most common being the Retirement Fund Administrator (Administradora de Fondos para el Retiro or Afore) system, voluntary savings plans, profit-sharing programs, and thrift plans.

Meal Vouchers

Some companies offer meal vouchers as part of compensation, helping employees cover daily food expenses and improving their overall well-being.

Stock Options

Stock option plans allow employees to purchase company shares at a fixed price, fostering a sense of ownership and alignment with business goals.

Gym Memberships

Providing gym memberships or wellness programs helps employees maintain a healthy lifestyle, reducing stress and increasing productivity.

Flexible Work Arrangements

Offering remote work or flexible hours improves work-life balance and employee satisfaction, making companies more attractive to top talent.

Tuition Reimbursement

Some employers cover education costs for employees pursuing further studies, enhancing their skills and career development.

Tax Implications of Employee Benefits in Mexico

Employee benefits in Mexico have specific tax implications. Employers can deduct mandatory benefits as business expenses, while supplemental benefits like meal vouchers and health insurance may also qualify for tax deductions if they meet legal requirements. Documentation, such as payroll records and receipts, is essential for compliance. Employees may face income tax on certain supplemental benefits.

How to Offer an Employee Benefits Program for Employees in Mexico

Set Budget & Goals

Begin by defining clear objectives for your employee benefits program. For example, you might want to boost employee satisfaction, improve retention rates or attract top talent globally. Now, establish a realistic budget that aligns with these goals, taking into account the financial implications of offering various benefits across different regions.

Use tools like Playroll’s employee cost calculator to benchmark your offering across regions.

Partner with Benefits Providers

Collaborate with reputable global benefits providers who have proven experience in international markets. These partners can ensure compliance, and offer insights into local regulations, cultural expectations as well as competitive standards – making your benefits program more attractive to employees in each country.

Customize Benefits for Local Culture and Expectations

Employee needs and preferences can vary significantly across cultures. That’s why it’s so important to tailor your benefits offerings to reflect local customs, values, and expectations. For instance, while flexible work arrangements might be highly valued in one country, healthcare benefits could be more critical in another. Customizing your benefits packages accordingly can help make your offering more competitive to local talent.

Playroll’s benefits team provides expert insights into tailoring your benefits packages in 180+ regions to local needs, helping to attract and retain top talent.

Communicate the Benefits Program to Employees

Good communication is crucial to ensure employees understand and make use of the benefits available to them. Use appropriate messaging channels to inform employees about the program's details, how to access benefits, and any relevant procedures.

Encourage open lines of communication within the organization, and update the team on any changes in the benefits program. It’s a good idea to conduct regular employee engagement surveys to get feedback on satisfaction with your benefits program, to make proactive changes as needed.

Legal Considerations for Employee Benefits in Mexico

Labor laws in Mexico, including the Federal Labor Law and Social Security Law, govern employee benefits. Employers must ensure timely payment of benefits such as the aguinaldo and profit-sharing. Non-compliance can result in significant penalties, including fines and legal actions. Employers should regularly review their benefits packages to ensure compliance with evolving regulations and maintain competitive offerings.

How Benefits Impact Employee Cost

Employee benefits significantly affect payroll costs in Mexico. Mandatory benefits such as social security contributions and the Christmas bonus increase employer expenses. However, offering supplemental benefits can enhance employee retention and productivity, ultimately saving costs associated with turnover. Employers can manage costs by optimizing benefit offerings and leveraging tax incentives.

How Can Playroll Help with Benefits Management in Mexico?

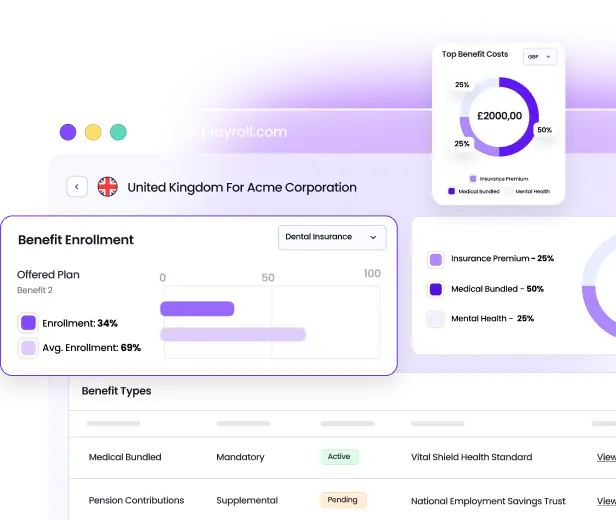

Managing employee benefits across multiple countries can be complex, but it doesn’t have to be. Playroll simplifies the process by handling administrative tasks, ensuring compliance with local regulations, and providing access to tailored benefits packages in 180+ regions.

With everything managed through a single platform, companies can focus on supporting their teams – wherever they are.

- Pick and choose from localized benefits packages to attract and retain global talent.

- Built-in compliance to stay ahead of evolving regulations.

- Manage leave, expenses, and more, through one intuitive dashboard.

Disclaimer

THIS CONTENT IS FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE LEGAL OR TAX ADVICE. You should always consult with and rely on your own legal and/or tax advisor(s). Playroll does not provide legal or tax advice. The information is general and not tailored to a specific company or workforce and does not reflect Playroll’s product delivery in any given jurisdiction. Playroll makes no representations or warranties concerning the accuracy, completeness, or timeliness of this information and shall have no liability arising out of or in connection with it, including any loss caused by use of, or reliance on, the information.

.svg)

.svg)

.svg)

.svg)

.png)

.webp)

.svg)