Developing a competitive employee benefits package in the United States can be difficult, especially for companies managing a distributed workforce. The complexity of this endeavor increases since employee benefits vary not only across companies but also across state lines.

However, certain full-time employee benefits required by law are federally mandated, and employers must fully understand and comply with these regulations. For example, employers with 50 or more full-time employees must offer certain benefits under laws like the Affordable Care Act (ACA) and the Family and Medical Leave Act (FMLA).

Playroll’s highly experienced team of compliance experts can help you traverse the murky waters of benefits packages, ensuring the observance and efficiency of local laws in the United States.

Looking to hire in one of the most competitive job markets in the world? Check out Playroll’s Guide to Hiring Employees in the United States.

In the United States, employee benefits encompass a range of legally mandated and voluntary offerings designed to support employees' well-being and financial security. Understanding these benefits is crucial for both employers and employees to ensure compliance and to foster a productive work environment.

Who Is Entitled to Employee Benefits in the United States

In the U.S., employee benefits are divided between legally required employee benefits and supplemental benefits that vary depending on the state or the employer's discretion. Federally mandated benefits like Social Security, Medicare, and unemployment insurance apply to all 50 states across the United States under federal law whereas benefits at a state level are dependent on the respective laws of the 50 states.

Federally mandated benefits are benefits that companies with full-time employees are legally required to provide to their workers. State-level requirements refer to benefits that may differ from one state to another. For example, employers in certain states (such as Colorado and New York) must provide paid leave to their employees due to state law.

Federal law and state law mandate certain benefits for full-time employees, while others, like voluntary benefits, are commonly offered to attract and retain talent. Access to voluntary benefits like health insurance, retirement plans, and paid leave often depends on factors such as full-time or part-time status, job classification, and tenure. Employers may set eligibility criteria, but they must adhere to regulations like the Employee Retirement Income Security Act (ERISA) to ensure fairness and non-discrimination in benefit distribution.

Overview of Employee Benefits in the United States

Employee benefits in the U.S. vary widely compared to other countries, especially those with universal healthcare and more extensive social safety nets. In the U.S., employers play a significant role in providing health insurance and retirement savings plans, making these benefits a central aspect of workplace culture. Offering a comprehensive benefits package is often essential for attracting and retaining talent in a competitive labor market.

Mandatory Employee Benefits in the United States

Social Security

Social Security provides income for retired workers, dependents of deceased workers, and disabled individuals and their families. Employers and employees each contribute a percentage of the employee's earnings up to a certain limit. Employers are required to withhold the appropriate amount from employees' paychecks and remit it to the Social Security Administration. Social Security offers financial stability to employees and their families during retirement or in the event of disability or death.

Medicare

Medicare is a federal health insurance program primarily for individuals aged 65 and older, as well as for certain younger people with disabilities. Employers and employees each contribute a percentage of the employee's earnings, with no wage base limit. Employers are responsible for withholding this tax from employees' wages and ensuring timely payment to the IRS. Medicare helps cover hospital care, medical services, and prescription drugs, thereby supporting the health and well-being of eligible employees.

Unemployment Insurance

Unemployment insurance provides temporary financial assistance to workers who have lost their jobs through no fault of their own. Funded by employer-paid federal and state payroll taxes, the specifics of unemployment insurance vary by state. Employers must register with their state's workforce agency, report wages, and pay the required taxes. This benefit ensures that employees have a safety net during periods of unemployment, helping them meet basic living expenses while they seek new employment.

Workers' Compensation

Workers' compensation insurance provides medical benefits and wage replacement to employees who suffer job-related injuries or illnesses. Employers are required to carry this insurance, which is regulated at the state level. Employers must obtain coverage through state programs or private insurers and comply with reporting and documentation requirements. Workers' compensation ensures that employees receive necessary medical care and financial support during recovery, promoting their health and financial stability.

Family and Medical Leave

The Family and Medical Leave Act (FMLA) entitles eligible employees to up to 12 weeks of unpaid, job-protected leave per year for specified family and medical reasons, such as the birth of a child or a serious health condition. Employers with 50 or more employees are required to comply with FMLA provisions. Employers must maintain accurate records and provide necessary documentation to employees regarding their rights under FMLA. This benefit allows employees to balance work and family responsibilities without fear of losing their jobs.

Supplemental Employee Benefits in the United States

Supplemental benefits are not required by law but can help employers attract and retain top talent. They include:

Health Insurance

While not federally mandated for all employers, many choose to offer health insurance to attract and retain employees. Employer-sponsored health plans can cover medical, dental, and vision expenses. Offering health insurance demonstrates a commitment to employees' well-being and can lead to a healthier, more productive workforce.

Retirement Plans (e.g., 401(k))

Retirement plans like 401(k)s allow employees to save for retirement with pre-tax contributions, often supplemented by employer matching contributions. These plans are regulated by the Employee Retirement Income Security Act (ERISA), which sets standards for plan management and fiduciary responsibilities. Providing retirement plans helps employees secure their financial future and can enhance job satisfaction and loyalty.

Life Insurance

Life insurance policies provide financial support to an employee's beneficiaries in the event of the employee's death. Employers may offer group-term life insurance as part of their benefits package. This benefit offers peace of mind to employees, knowing their loved ones will have financial assistance if needed.

Disability Insurance

Disability insurance offers income protection to employees who are unable to work due to illness or injury. Employers can provide short-term and long-term disability coverage, which may be fully funded by the employer or shared with employees. This benefit ensures financial stability for employees during periods of disability, reducing stress and aiding in recovery.

Dental and Vision Insurance

Dental and vision insurance plans cover expenses related to dental care and eye health, respectively. These plans are often offered as part of a comprehensive benefits package. Providing dental and vision coverage addresses important aspects of employees' overall health, contributing to their well-being and satisfaction.

Paid Time Off (PTO)

This highly desirable benefit typically includes paid vacation days, sick leave, and personal days for employees. While this benefit is not legally required, it certainly helps improve employees’ work-life balance and general well-being.

Equity Benefits

Equity benefits are an investment opportunity that employers can present to their employees in the form of non-cash payments. When implemented, this benefit makes employees partial owners of the company they work for. As an added bonus, employees tend to be more motivated to ensure the company’s growth if they have a personal stake in it.

Tax Implications of Employee Benefits in the United States

Employee benefits in the U.S. have various tax implications:

- Taxation of Benefits: Some benefits, like health insurance premiums paid by employers, are excluded from employees' taxable income. Conversely, certain benefits, such as bonuses or gift cards, are considered taxable income.

- Employer Tax Benefits: Employers can often deduct the cost of providing benefits like health insurance and retirement plan contributions as business expenses, reducing taxable income.

- Documentation for Compliance: Employers must maintain accurate records of benefit offerings, contributions, and employee elections to comply with IRS regulations and substantiate tax deductions.

How to Offer an Employee Benefits Program for Employees in the United States

Set Budget & Goals

Begin by defining clear objectives for your employee benefits program. For example, you might want to boost employee satisfaction, improve retention rates or attract top talent globally. Now, establish a realistic budget that aligns with these goals, taking into account the financial implications of offering various benefits across different regions.

Use tools like Playroll’s employee cost calculator to benchmark your offering across regions.

Partner with Benefits Providers

Collaborate with reputable global benefits providers who have proven experience in international markets. These partners can ensure compliance, and offer insights into local regulations, cultural expectations as well as competitive standards – making your benefits program more attractive to employees in each country.

Customize Benefits for Local Culture and Expectations

Employee needs and preferences can vary significantly across cultures. That’s why it’s so important to tailor your benefits offerings to reflect local customs, values, and expectations. For instance, while flexible work arrangements might be highly valued in one country, healthcare benefits could be more critical in another. Customizing your benefits packages accordingly can help make your offering more competitive to local talent.

Playroll’s benefits team provides expert insights into tailoring your benefits packages in 180+ regions to local needs, helping to attract and retain top talent.

Communicate the Benefits Program to Employees

Good communication is crucial to ensure employees understand and make use of the benefits available to them. Use appropriate messaging channels to inform employees about the program's details, how to access benefits, and any relevant procedures.

Encourage open lines of communication within the organization, and update the team on any changes in the benefits program. It’s a good idea to conduct regular employee engagement surveys to get feedback on satisfaction with your benefits program, to make proactive changes as needed.

Legal Considerations for Employee Benefits in the United States

Employers in the United States must navigate a complex landscape of federal and state regulations governing employee benefits. The Employee Retirement Income Security Act of 1974 (ERISA) is a pivotal federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry, aiming to protect individuals enrolled in these plans.

ERISA mandates that plan fiduciaries—those responsible for managing and controlling plan assets—adhere to specific duties, including acting solely in the interest of plan participants and beneficiaries, following the plan documents, and diversifying plan investments to minimize the risk of significant losses. Non-compliance with ERISA can lead to substantial penalties, such as fines for failing to provide requested plan-related information.

Beyond ERISA, employers must comply with federal laws such as the Affordable Care Act (ACA), which requires applicable large employers to offer affordable health coverage to full-time employees or face penalties. Employers are also required to adhere to the Family and Medical Leave Act (FMLA), which provides job-protected leave for eligible employees. Regular review of benefit plans and administrative practices is essential to ensure compliance with these laws and avoid penalties.

How Benefits Impact Employee Cost

Employee benefits significantly influence overall payroll costs for employers in the United States. Mandatory benefits, such as Social Security, Medicare, unemployment insurance, and workers' compensation, require employers to contribute a portion of their payroll expenses. Supplemental benefits like health insurance, retirement plans, and paid leave can further increase labor costs but are critical for attracting and retaining talent.

To manage costs while offering competitive benefits, employers can consider strategies such as conducting regular benefit audits, offering flexible cafeteria-style plans, and promoting wellness initiatives to improve employee health and reduce long-term healthcare expenses. Providing a comprehensive benefits package can enhance employee satisfaction, retention, and productivity, fostering a positive workplace culture.

How Can Playroll Help with Benefits Management in the United States?

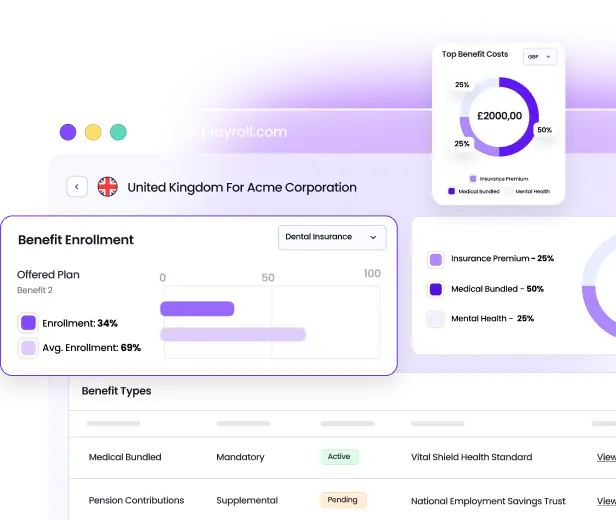

Managing employee benefits across multiple countries can be complex, but it doesn’t have to be. Playroll simplifies the process by handling administrative tasks, ensuring compliance with local regulations, and providing access to tailored benefits packages in 180+ regions.

With everything managed through a single platform, companies can focus on supporting their teams – wherever they are.

- Pick and choose from localized benefits packages to attract and retain global talent.

- Built-in compliance to stay ahead of evolving regulations.

- Manage leave, expenses, and more, through one intuitive dashboard.

Disclaimer

THIS CONTENT IS FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE LEGAL OR TAX ADVICE. You should always consult with and rely on your own legal and/or tax advisor(s). Playroll does not provide legal or tax advice. The information is general and not tailored to a specific company or workforce and does not reflect Playroll’s product delivery in any given jurisdiction. Playroll makes no representations or warranties concerning the accuracy, completeness, or timeliness of this information and shall have no liability arising out of or in connection with it, including any loss caused by use of, or reliance on, the information.

.svg)

.svg)

.svg)

.svg)

.png)

.webp)

.svg)