Classifying Your Workers Correctly

Your company must decide whether each Minnesota worker is an employee or an independent contractor using the IRS common law control test and state guidance from the Department of Labor and Industry. You should look at who controls how work is done, who provides tools, whether the worker can realize profit or loss, and whether the relationship is ongoing. Misclassification can trigger back wages, unpaid overtime, tax assessments, interest, and civil penalties, and you may also owe unpaid unemployment insurance and workers’ compensation premiums.

Minnesota uses similar factors to the IRS but may apply them more strictly in construction, trucking, and other high‑risk industries, so you should review written contracts and actual practices together. To reduce risk, you should document your classification analysis, keep records of invoices and business registrations for contractors, and review Playroll’s employee misclassification guide at https://www.playroll.com/blog/employee-misclassification-guide before engaging freelancers in Minnesota.

Verify Employee Work Eligibility

For every Minnesota employee you hire, you must complete federal Form I‑9 within 3 business days of the employee’s start date to verify identity and work authorization. You must physically examine original documents from the Lists of Acceptable Documents, such as a U.S. passport or a combination of a state ID and Social Security card, and you cannot specify which documents the employee must present. Minnesota does not currently mandate E‑Verify for most private employers, but you may choose to use it voluntarily if you apply it consistently to all new hires at a given location.

You must retain each I‑9 for at least 3 years after the hire date or 1 year after employment ends, whichever is later, and store them separately from general personnel files to protect privacy. Your company should also ensure that any remote I‑9 inspection follows current federal rules, and that you have a clear internal process for reverifying expiring work authorization documents.

Create an Employee Onboarding Process

When onboarding employees in Minnesota, you should issue a written offer letter that clearly states job duties, pay rate, exempt or nonexempt status, and work location. On or before the first day, you must collect federal Form W‑4 and Minnesota Form W‑4MN for tax withholding, plus any direct deposit authorization, and you should provide your employee handbook and obtain signed acknowledgments of key policies. Minnesota also requires a written notice at hire with specific wage and benefit information, and you must give a written earnings statement each payday.

Your onboarding checklist should also cover required posters, workers’ compensation information, and how employees can access earned sick and safe time if applicable. Building these steps into a repeatable workflow with Playroll helps you see the full cost of hiring in Minnesota – including wages, taxes, and benefits – before you make an offer.

Pay Frequency & Methods

In Minnesota, you must pay wages at least once every 31 days for most employees, and at least once every 15 days for certain manual workers if you promise more frequent pay. If you terminate an employee, you must pay all earned wages by the next regularly scheduled payday, and if you discharge an employee and they demand payment in writing, you generally must pay within 24 hours or risk wage penalties. Your company should maintain accurate time records for at least 3 years and ensure that any deductions from pay are lawful and authorized in writing.

Payment Methods (How You Can Pay)

You can choose from several compliant payment methods in Minnesota, but you must always ensure employees receive full wages on time and a clear earnings statement each payday.

- Payroll Check: You may pay by check drawn on a Minnesota‑accessible bank, and you must ensure employees can cash it at full face value without fees.

- Cash: You may pay wages in cash, but you must provide a written wage statement showing hours, rates, gross pay, and all deductions each pay period.

- Direct Deposit (EFT): You can use direct deposit only if the employee voluntarily authorizes it, and you must offer at least one no‑fee option for accessing wages.

- Paycards: You may pay by payroll card if employees have fee‑free access to full wages at least once per pay period and receive clear disclosures of any card fees.

- Outsourced Payroll: You may use a payroll provider, but your company remains responsible for compliance with Minnesota wage, tax, and recordkeeping laws.

When you hire employees in Minnesota, you must withhold and remit federal and state payroll taxes and pay several employer‑only contributions. You will need to register with the Minnesota Department of Revenue and the Department of Employment and Economic Development before running payroll.

Employer Tax Contributions

Your company must budget for employer‑side taxes in Minnesota, including Social Security, Medicare, state unemployment insurance, and any applicable local obligations. You must obtain a Minnesota tax ID number, file returns on the required schedule, and keep payroll records that support all reported wages and taxes.

Employee Payroll Tax Contributions

You must withhold federal and Minnesota income taxes and the employee portions of Social Security and Medicare from each paycheck. Withholding amounts are based on the employee’s Form W‑4 and Form W‑4MN, and you must remit them on the schedule assigned by the IRS and the Minnesota Department of Revenue.

Minimum Wage in Minnesota

As of 2024, Minnesota’s state minimum wage is $10.85 per hour for large employers with annual gross revenues of $500,000 or more, and $8.85 per hour for small employers, youth under 18, and certain training wages. If your company is covered by the federal Fair Labor Standards Act, you must pay at least the higher of the state or federal minimum wage, and some Minnesota cities may set higher local minimums that you must also follow.

Working Hours in Minnesota

Minnesota does not cap the number of hours adults may work in most private jobs, but you must pay at least the applicable minimum wage for all hours worked and provide adequate meal and rest breaks. State law generally requires a reasonable unpaid meal break for shifts of 8 or more consecutive hours and sufficient time to use the restroom during each 4 consecutive hours worked, so your scheduling practices should account for these requirements.

Overtime in Minnesota

In Minnesota, you must pay nonexempt employees overtime at 1.5 times their regular rate for all hours worked over 40 in a workweek, and state law also has an overtime trigger after 48 hours for some employers. You should carefully determine exempt status under both federal and state law, track all hours actually worked, and include nondiscretionary bonuses and certain differentials when calculating the regular rate for overtime purposes.

Offering a strong benefits package in Minnesota helps you stay competitive, especially in tight labor markets around Minneapolis–St. Paul and other urban centers. If you average 50 or more full‑time employees, the federal Affordable Care Act requires you to offer affordable, minimum‑value health coverage or face potential penalties, and many Minnesota employers also provide retirement plans, disability coverage, and supplemental benefits to attract talent.

Mandatory Leave Policies in Minnesota

Paid Time Off in Minnesota

Minnesota does not require general vacation or PTO, but once your company offers it, you must follow your written policy on accrual, use, and payout. Many employers combine vacation, personal days, and sick time into a single PTO bank, but you must keep ESST entitlements compliant and clearly distinguish any separate paid leave benefits in your handbook.

State law does not mandate payout of unused vacation at termination, but Minnesota courts often enforce your written policy, so you should state clearly whether unused PTO is forfeited or paid when employment ends. To stay competitive, especially in professional roles, many Minnesota employers offer at least 10–15 days of PTO per year plus paid holidays.

Maternity & Paternity Leave in Minnesota

Under Minnesota’s Pregnancy and Parenting Leave law, eligible employees may take up to 12 weeks of unpaid, job‑protected leave for pregnancy, childbirth, and bonding with a newborn or newly adopted child. This state leave can run concurrently with federal FMLA if your company is covered, so you should coordinate both laws when tracking time off.

You are not required to provide paid maternity or paternity leave beyond earned sick and safe time, but many employers offer short‑term disability benefits or supplemental paid parental leave to attract and retain talent. Your policies should clearly explain eligibility, how benefits interact with ESST and any disability income, and how employees maintain health coverage while on leave.

Sick Leave in Minnesota

Most Minnesota employers must now provide earned sick and safe time, allowing employees to accrue at least 1 hour of paid leave for every 30 hours worked, up to at least 48 hours per year, for their own or a family member’s illness, medical appointments, or safety‑related needs. You may cap accrual and carryover within statutory limits or frontload the full annual amount, but you must track balances and show them on pay statements or in another accessible way.

Your company may set reasonable notice and documentation rules for ESST, such as requiring advance notice for foreseeable absences, but you cannot require employees to find replacements or retaliate for using lawful sick time. Local ordinances in cities like Minneapolis and St. Paul may impose additional requirements, so you should confirm which rules apply to each work location.

Military Leave in Minnesota

Minnesota law and the federal Uniformed Services Employment and Reemployment Rights Act protect employees who serve in the National Guard, reserves, or other uniformed services. You must allow unpaid leave for military duty, maintain certain benefits, and reinstate returning service members to the same or a comparable position if they meet eligibility criteria.

Your policies should explain how employees request military leave, how they can use accrued PTO or ESST during service if they choose, and how health and retirement benefits are handled during longer absences. You may not discriminate or retaliate against employees because of their military obligations.

Jury Duty in Minnesota

You must allow employees time off to serve on a jury in Minnesota and may not threaten, coerce, or penalize them for complying with a summons. State law does not require you to pay employees for this time, but many employers choose to provide some paid jury leave or allow employees to use PTO to avoid income loss.

Your company should set a simple process for employees to provide jury notices and confirm expected absence dates, and you should adjust schedules as needed so they can fulfill their civic duty without workplace pressure.

Voting Leave in Minnesota

Minnesota requires you to provide paid time off for employees to vote on election days when they do not have sufficient time to vote outside their working hours. You may not dock pay, require employees to use PTO, or retaliate against them for taking reasonable time off to vote.

To minimize disruption, you can encourage employees to coordinate with supervisors about when they will be away, but you cannot require them to use a specific time window if it would interfere with their ability to vote.

Bereavement Leave in Minnesota

Minnesota law does not mandate bereavement leave, but many employers voluntarily provide 1–5 days of paid or unpaid leave for the death of an immediate family member. Clear written policies help ensure consistent treatment and set expectations about which relationships qualify and whether documentation is required.

Even if you do not offer a formal bereavement benefit, you should be prepared to consider flexible scheduling or use of PTO or ESST for employees dealing with a loss, especially when travel or caregiving responsibilities are involved.

Termination Process

Minnesota is an at‑will employment state, so you or the employee may generally end the relationship at any time for any lawful reason, but you should still follow a consistent, documented process. Your company should review performance records, apply policies uniformly, and provide a clear termination letter summarizing the effective date, final pay details, and any benefits information to reduce legal risk.

Notice Period

Minnesota law does not require you to give advance notice of termination in most private employment, unless a contract or collective bargaining agreement says otherwise. However, you must pay all earned wages by the next regular payday, and if a discharged employee makes a written demand for payment, you generally must pay within 24 hours or face potential wage penalties.

Severance

Severance pay is not required under Minnesota law, but many employers offer it in layoffs or negotiated separations in exchange for a release of claims. If you provide severance, you should use a written agreement that complies with federal and state rules on waivers, age discrimination, and any applicable notice requirements, and you must pay severance as promised to avoid breach‑of‑contract claims.

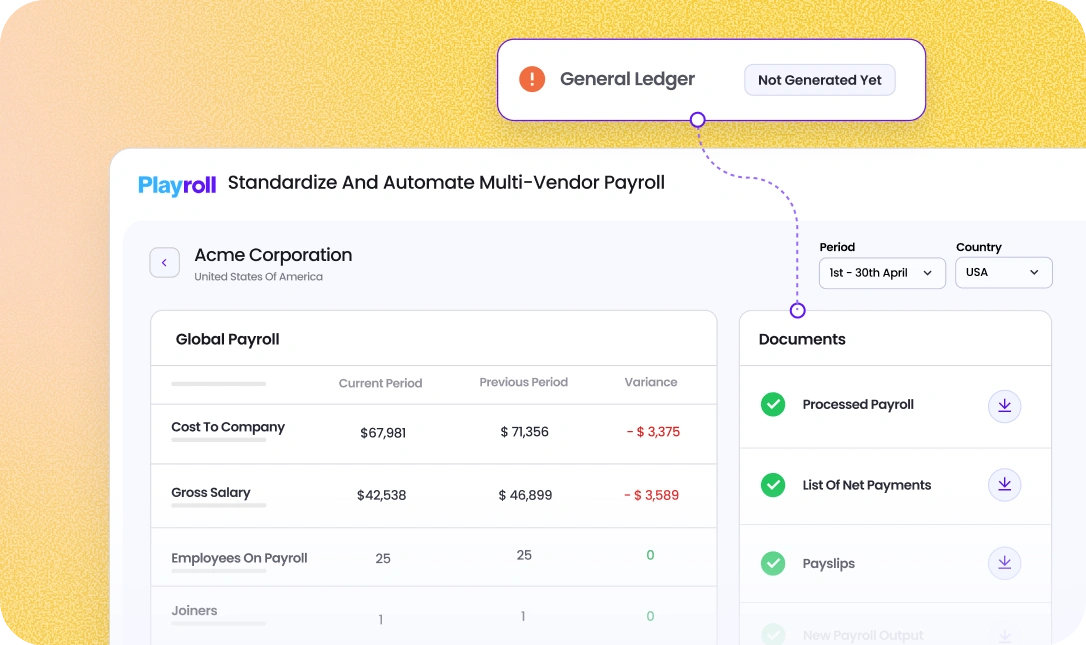

How do you set up payroll processing in Minnesota?

.png)

To set up payroll processing in Minnesota, you first need to obtain a federal EIN and register for a Minnesota tax ID with the Department of Revenue and for unemployment insurance with the Department of Employment and Economic Development. Then you should choose a payroll system, collect Form W‑4 and Form W‑4MN from each employee, track hours worked, calculate and withhold federal and Minnesota income taxes plus Social Security and Medicare, and remit all taxes and reports on the schedules assigned by each agency while keeping detailed payroll records for several years.

How does an Employer of Record help you hire in Minnesota?

.png)

An Employer of Record helps you hire in Minnesota by acting as the legal employer for tax and compliance purposes while you manage the employee’s day‑to‑day work. The provider handles Minnesota‑specific onboarding, payroll, tax registrations, withholding, benefits, and required notices, so you can add staff in the state quickly without creating a local entity or learning every detail of Minnesota employment law yourself.

Is there a minimum wage requirement for employees in Minnesota?

.png)

Yes, there is a minimum wage requirement for employees in Minnesota, and it is higher than the federal minimum for many employers. As of 2024, large employers with at least $500,000 in annual gross revenue must pay at least $10.85 per hour, while small employers and certain youth or training wages may use a lower $8.85 per hour rate, and you must also comply with any higher local minimums set by cities where your employees work.

How much does it cost to employ someone in Minnesota?

.png)

The cost to employ someone in Minnesota includes more than just their hourly wage or salary; you must also budget for employer payroll taxes, state unemployment insurance contributions, workers’ compensation premiums, and any health, retirement, or paid leave benefits you offer. For planning, many employers estimate that total employment costs in Minnesota run 15–30% above base pay, depending on your industry, claims history, and how generous your benefits package is.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)