Classifying Your Workers Correctly

Your company must distinguish properly between employees and independent contractors under IRS common law tests and Pennsylvania’s stricter construction industry test. You should look at behavioral control, financial control, and the overall relationship to decide if a worker belongs on payroll or should be treated as a contractor.

Pennsylvania can assess back wages, unpaid unemployment and workers’ compensation premiums, taxes, interest, and civil penalties if you misclassify workers. You should review the federal guidance and Playroll’s misclassification guide before finalizing roles.

Verify Employee Work Eligibility

For every new hire in Pennsylvania, you must complete federal Form I-9 within 3 business days of the employee’s start date. You must physically inspect acceptable identity and work authorization documents, such as a U.S. passport or a driver’s license plus Social Security card.

Pennsylvania does not mandate E-Verify for all private employers, but certain public works contractors and subcontractors must use it under state law. You must retain I-9s for at least 3 years after hire or 1 year after termination, whichever is later, and store them separately from general personnel files.

Create an Employee Onboarding Process

When you hire in Pennsylvania, you should issue a written offer letter outlining pay rate, pay schedule, exempt or nonexempt status, and key policies. On or before day one, you must collect federal Form W-4, Pennsylvania Form PA-WT or equivalent withholding details, direct deposit authorization if used, and signed acknowledgments of your handbook and required notices.

You must also complete Pennsylvania new hire reporting within 20 days and provide any local wage tax forms where applicable, such as in Philadelphia. As you design onboarding, build in clear visibility of total hiring costs – including taxes, insurance, and benefits – so you can budget accurately for each Pennsylvania employee.

Pay Frequency & Methods

Pennsylvania requires you to pay wages on regular paydays at least semi-monthly, with no more than 15 days’ lag between the end of a pay period and payday in most cases. If you terminate an employee, you must pay all earned wages by the next regular payday, and failure to do so can trigger wage claims, liquidated damages up to 25% of unpaid wages, and attorney’s fees.

Payment Methods (How You Can Pay)

In Pennsylvania, you can choose among several payment methods as long as employees receive full wages on time and get an accurate written wage statement each pay period.

- Payroll Check: You may pay by check drawn on a Pennsylvania bank, and you must ensure employees can cash it at full face value without fees.

- Cash: You may pay wages in cash, but you must provide a written pay stub showing hours, rates, gross pay, and all deductions.

- Direct Deposit (EFT): You may use direct deposit only if employees voluntarily consent and have the option to choose their own financial institution.

- Paycards: You may use payroll cards if employees have fee-free access to full wages at least once per pay period and receive clear disclosures of any card fees.

- Outsourced Payroll: You may outsource payroll to a third-party provider, but your company remains responsible for compliance with Pennsylvania wage payment and tax laws.

When selecting payment methods, you should confirm that any bank, paycard program, or payroll vendor can handle Pennsylvania’s timing rules, local tax withholding, and detailed recordkeeping requirements.

When you hire employees in Pennsylvania, you must withhold state and local income taxes, pay state unemployment contributions, and handle federal payroll taxes. You will need to register with both the Pennsylvania Department of Revenue and the Office of Unemployment Compensation before running your first payroll.

Employer Tax Contributions

As an employer, you are responsible for Pennsylvania unemployment insurance contributions and for remitting withheld state and local income taxes. You must also pay federal Social Security, Medicare, and FUTA taxes according to IRS rules.

Employee Payroll Tax Contributions

Your Pennsylvania employees fund part of the tax burden through withholdings from each paycheck, including state income tax, local earned income tax where applicable, and their share of FICA. You must calculate, withhold, and remit these amounts on the correct schedule.

Minimum Wage in Pennsylvania

Pennsylvania’s minimum wage is currently $7.25 per hour, matching the federal rate, with a lower cash wage allowed for tipped employees if tips bring them to at least $7.25. You must also comply with any higher federal or contractual wage obligations that apply to your business.

Working Hours in Pennsylvania

Pennsylvania generally follows federal Fair Labor Standards Act rules on hours worked, requiring you to pay for all hours an employee is suffered or permitted to work. Minors face additional limits on daily and weekly hours, night work, and school-day employment under Pennsylvania’s child labor law.

Overtime in Pennsylvania

Nonexempt employees in Pennsylvania must receive overtime pay at 1.5 times their regular rate for all hours worked over 40 in a workweek. You must accurately track hours, correctly determine the regular rate including certain bonuses, and classify exempt employees under federal and state duties and salary tests.

In Pennsylvania, you decide which benefits to offer beyond what federal and state law require, but competitive employers typically provide health insurance, retirement plans, and paid time off. If you average 50 or more full-time employees nationwide, the federal ACA requires you to offer affordable health coverage or face potential penalties.

Mandatory Leave Policies in Pennsylvania

Paid Time Off in Pennsylvania

Pennsylvania does not require private employers to provide paid vacation or general PTO, so you can design your own policy. Once you promise PTO in a handbook or contract, you must follow your written rules on accrual, carryover, and payout at termination.

Some Pennsylvania cities, such as Philadelphia and Pittsburgh, have local paid sick leave ordinances that may affect how you structure PTO. You should decide whether to use a single PTO bank or separate vacation and sick leave, and clearly communicate the rules to employees.

Maternity & Paternity Leave in Pennsylvania

Pennsylvania does not have a separate statewide paid parental leave program, but eligible employees may qualify for up to 12 weeks of unpaid, job-protected leave under the federal FMLA. The Pennsylvania Human Relations Act also requires you to treat pregnancy and childbirth the same as other temporary disabilities for leave and benefits purposes.

Your company can choose to offer paid parental leave or short-term disability benefits to remain competitive in the Pennsylvania talent market. Make sure your policy applies consistently to all parents, including fathers, adoptive parents, and partners, to avoid discrimination risks.

Sick Leave in Pennsylvania

There is no statewide mandate for paid sick leave in Pennsylvania, but several municipalities require certain employers to provide it, including Philadelphia and Pittsburgh. If you have employees in those cities, you must track hours worked there and provide the required accrual, usage, and notice rights.

Even where not required, many Pennsylvania employers offer paid sick time to reduce presenteeism and support retention. You should define eligible uses, such as personal illness, family care, or domestic violence situations, and align your policy with any local ordinance that applies.

Military Leave in Pennsylvania

Pennsylvania employees who serve in the National Guard or U.S. Armed Forces are protected by both USERRA and state law. You must provide unpaid leave for military service, preserve seniority and benefits as required, and promptly reinstate eligible employees when they return.

Some employers in Pennsylvania voluntarily offer differential pay to make up the gap between military pay and regular wages. Whatever you decide, apply your policy consistently and keep documentation of orders and return dates.

Jury Duty in Pennsylvania

You must allow employees time off to serve on a jury in Pennsylvania and may not threaten or penalize them for complying with a summons. State law does not require you to pay for this time, but many employers choose to pay at least a limited number of days.

You can request proof of jury service, such as a court notice or attendance slip, and you should specify in your policy whether exempt employees’ pay will be reduced for partial-week absences, consistent with federal salary basis rules.

Voting Leave in Pennsylvania

Pennsylvania law protects employees from being fired or threatened for taking reasonable time to vote when they do not have sufficient time outside working hours. While the statute does not set a specific number of hours or require paid time, you should allow flexibility when polls are open only during most of an employee’s shift.

Your company can adopt a written voting leave policy that explains how employees should request time off and whether the time is paid or unpaid. Clear communication helps avoid last-minute scheduling conflicts on election days.

Bereavement Leave in Pennsylvania

Pennsylvania does not mandate bereavement leave for private employers, so any time off for a death in the family is governed by your internal policy or a collective bargaining agreement. Many employers provide 3 to 5 paid days for immediate family members and 1 day for extended relatives.

When you design a bereavement policy, consider including flexible options for travel or cultural and religious observances. Apply your rules consistently to avoid discrimination claims and communicate them clearly during onboarding.

Termination Process

Pennsylvania is an at-will employment state, so you or the employee may end the relationship at any time for any lawful reason, unless a contract states otherwise. You should document performance issues, follow your disciplinary procedures, and provide a clear termination letter summarizing final pay, benefits, and return of company property.

Notice Period

Pennsylvania law does not require advance notice of termination for individual employees, though federal WARN rules may apply to large layoffs or plant closings. If you choose to use notice periods or pay in lieu of notice, you must follow any written contracts or policies you have in place.

Severance

Severance pay is not required under Pennsylvania law, but many employers offer it in exchange for a signed release of claims, especially for long-tenured or higher-level employees. If you provide severance, you should use a written agreement that complies with federal and state rules on waivers, age discrimination, and payment timing.

How do you set up payroll processing in Pennsylvania?

.png)

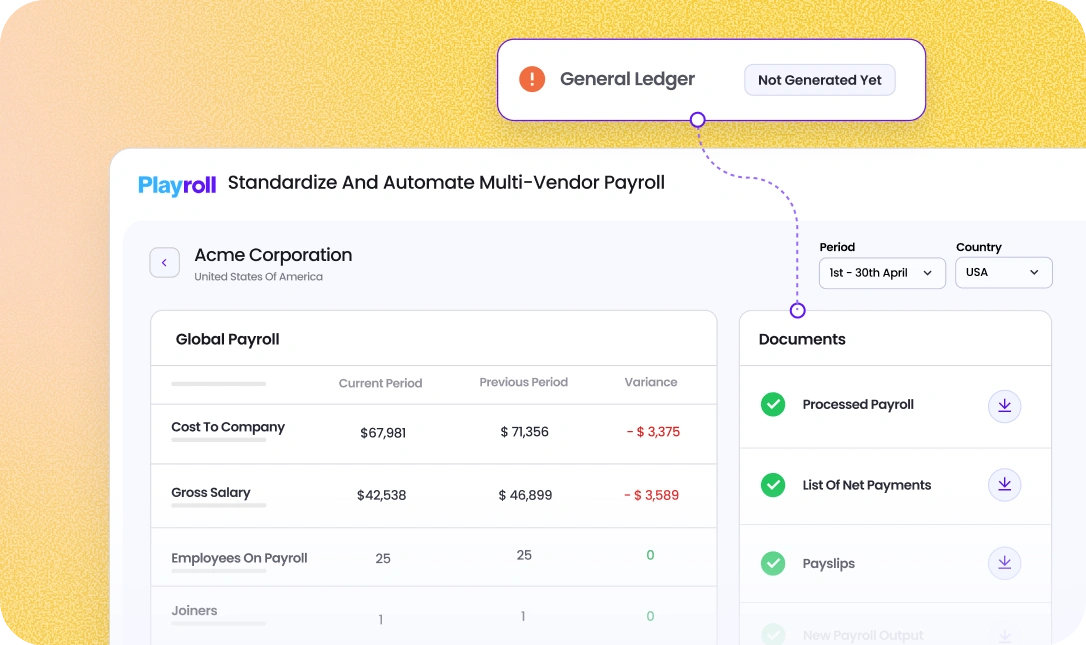

To set up payroll processing in Pennsylvania, you first register your business with the Pennsylvania Department of Revenue for state income tax withholding and with the Office of Unemployment Compensation for state unemployment insurance. Then you obtain federal EIN registration, choose a pay frequency that meets Pennsylvania’s semi-monthly minimum, configure your system to withhold the 3.07% state income tax plus any local earned income tax, and ensure you can file and pay electronically on the required schedules.

How does an Employer of Record help you hire in Pennsylvania?

.png)

An Employer of Record helps you hire in Pennsylvania by acting as the legal employer for tax and labor law purposes while you manage the employee’s work. The provider handles Pennsylvania-compliant onboarding, payroll, state and local tax withholding, unemployment and workers’ compensation coverage, and required notices, so you can add staff in the state without opening a local entity or building in-house compliance expertise.

Is there a minimum wage requirement for employees in Pennsylvania?

.png)

Yes, there is a minimum wage requirement for employees in Pennsylvania, and it currently matches the federal rate of $7.25 per hour for most non-tipped workers. You must also ensure that tipped employees receive at least $7.25 per hour when you combine their cash wage and tips, and you must follow any higher wage rates that apply under federal contracts or collective bargaining agreements.

How much does it cost to employ someone in Pennsylvania?

.png)

The cost to employ someone in Pennsylvania includes their gross wages plus employer-side taxes such as Social Security, Medicare, federal and state unemployment contributions, workers’ compensation premiums, and any benefits you offer like health insurance or retirement plans. You should also budget for local earned income tax administration, payroll service fees, and indirect costs such as equipment, training, and paid time off to understand the true total compensation for a Pennsylvania hire.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)