Classifying Your Workers Correctly

Your company must distinguish properly between employees and independent contractors under IRS common law tests and Wisconsin’s wage and hour rules. You should look at behavioral control, financial control, and the overall relationship to decide if a worker is truly independent. Wisconsin can hold you liable for back wages, unemployment insurance, workers’ compensation premiums, taxes, interest, and civil penalties if you misclassify people.

For higher‑risk roles, you should document why you chose a contractor classification and review it annually. If you are unsure, you can review federal guidance and resources such as Playroll's misclassification guide. Plus, consider getting legal or HR advice before hiring.

Verify Employee Work Eligibility

Every time you hire in Wisconsin, you must complete federal Form I‑9 within 3 business days of the employee’s start date. You must physically inspect original identity and work authorization documents, such as a U.S. passport or a driver’s license plus Social Security card. Wisconsin does not mandate E‑Verify for private employers, but you may use it voluntarily if you follow federal program rules.

You must keep I‑9s for the longer of 3 years after the hire date or 1 year after termination, and store them separately from general personnel files. You should apply the same verification process to all new hires in Wisconsin to avoid discrimination claims and ensure consistent compliance.

Create an Employee Onboarding Process

For each Wisconsin hire, you should issue a written offer letter outlining pay rate, exempt or nonexempt status, work schedule, and at‑will language. On or before day one, you will collect federal Form W‑4, Wisconsin Form WT‑4 for state withholding, direct deposit details if used, and signed acknowledgments for your handbook and key policies. You must also complete new hire reporting to the Wisconsin Department of Children and Families within 20 days of the hire date.

Wisconsin requires you to provide information about unemployment insurance and, where applicable, workers’ compensation coverage, so include these notices in your onboarding packet. Building a consistent onboarding checklist helps you control hiring costs and gives you clear visibility into total compensation for each Wisconsin employee.

Pay Frequency & Methods

Wisconsin generally requires you to pay employees at least monthly, and many employers choose biweekly or semimonthly schedules to stay competitive. You must pay wages earned in a pay period within 31 days of the end of that period, and late payment can trigger wage claims and statutory penalties. Final wages are due by the next regular payday, though you may choose to pay earlier as a best practice.

Payment Methods (How You Can Pay)

When you run payroll in Wisconsin, you can choose among several payment methods as long as employees receive full wages on time and get an accurate written wage statement each pay period.

- Payroll Check: You may pay by check drawn on a Wisconsin‑accessible bank, and you must ensure employees can cash it at full value without fees.

- Cash: You may pay wages in cash, but you must give employees a written statement each payday showing hours, rates, gross pay, and all deductions.

- Direct Deposit (EFT): You can offer direct deposit, but participation must be voluntary and you must obtain written consent and allow employees to choose their financial institution.

- Paycards: You may use payroll cards if employees have fee‑free access to their full net wages at least once per pay period and receive clear disclosures of any card fees.

- Outsourced Payroll: You can outsource payroll to a third‑party provider, but your company remains responsible for accurate wage payments, tax withholding, and recordkeeping under Wisconsin law.

When you hire employees in Wisconsin, you must withhold and remit federal and state payroll taxes and pay several employer contributions. You will register for Wisconsin withholding and unemployment accounts, calculate taxes each pay period, and file returns on the schedule assigned by the state.

Employer Tax Contributions

Your company will pay employer‑side Social Security and Medicare, Wisconsin unemployment insurance, and in some cases federal unemployment tax. You must register with the Wisconsin Department of Revenue for withholding and with the Wisconsin Department of Workforce Development for unemployment insurance before your first payroll.

Employee Payroll Tax Contributions

Wisconsin employees fund part of their Social Security and Medicare taxes and pay state income tax through withholding from each paycheck. Your company must calculate and withhold these amounts using current IRS and Wisconsin Department of Revenue tables and remit them on the required deposit schedule.

Minimum Wage in Wisconsin

Wisconsin’s general minimum wage is $7.25 per hour, the same as the federal rate, and you must pay at least this amount to most nonexempt employees. A lower minimum may apply to certain tipped employees and minors, but you must ensure tips and cash wages together reach at least $7.25 per hour.

Working Hours in Wisconsin

Wisconsin does not cap the number of hours adults may work, but you must pay for all hours suffered or permitted to work and comply with youth employment limits. State law requires meal and rest period protections for minors, and you should schedule reasonable breaks for adults to reduce fatigue and safety risks.

Overtime in Wisconsin

Most nonexempt employees in Wisconsin earn overtime at 1.5 times their regular rate for all hours worked over 40 in a workweek. You should define your fixed 7‑day workweek in writing, track all hours worked, and confirm that any salaried employees you treat as exempt meet both federal and state exemption tests.

In Wisconsin, you decide which benefits to offer beyond what federal and state law require, but strong health, retirement, and paid time off packages help you compete for talent. If you average 50 or more full‑time employees in the U.S., the Affordable Care Act requires you to offer affordable, minimum‑value health coverage or face potential penalties.

Mandatory Leave Policies in Wisconsin

Paid Time Off in Wisconsin

Wisconsin does not require you to provide paid vacation or general PTO, so your policy can be as flexible or traditional as your business needs. If you choose to offer PTO, you should put accrual rules, caps, and payout practices in writing and apply them consistently to avoid wage disputes.

State law does not mandate payout of unused vacation at termination, but your written policy or past practice can create an obligation. To manage costs, you may set clear rules on carryover and maximum accruals while still offering enough PTO to attract Wisconsin talent.

Maternity & Paternity Leave in Wisconsin

Wisconsin’s FMLA provides eligible employees of covered employers with up to 6 weeks of unpaid leave in a 12‑month period for the birth or adoption of a child, plus additional unpaid leave for their own or a family member’s serious health condition. Federal FMLA may provide up to 12 weeks of unpaid, job‑protected leave, and the two laws run concurrently when both apply.

You are not required to offer paid maternity or paternity leave, but many Wisconsin employers layer paid parental leave or short‑term disability benefits on top of FMLA to remain competitive. You should clearly explain how parental leave interacts with PTO, short‑term disability, and health benefits continuation.

Sick Leave in Wisconsin

Wisconsin does not have a statewide paid sick leave mandate for private employers, so you are not required to offer paid sick days. If you do provide sick leave or allow PTO to be used for illness, your policy should define eligibility, accrual, permitted uses, and any documentation requirements.

Under Wisconsin FMLA and federal FMLA, eligible employees may take unpaid, job‑protected leave for serious health conditions. You should coordinate your internal sick leave or PTO policies with these laws to ensure employees receive the protections they are entitled to without double‑counting time.

Military Leave in Wisconsin

Wisconsin law and the federal USERRA statute protect employees who take leave for active duty, training, or other covered military service. You must allow unpaid time off for qualifying service and restore the employee to the same or an equivalent position upon timely return, with preserved seniority and benefits.

You are not required to pay employees during military leave, but some Wisconsin employers choose to provide differential pay or continued benefits as a competitive perk. You should also ensure that employees on military leave continue to receive any non‑seniority benefits required by law.

Jury Duty in Wisconsin

In Wisconsin, you must allow employees time off to serve on a jury and may not discipline or terminate them for complying with a summons. State law does not require you to pay employees for jury duty, but if you do pay, you may offset any juror fees according to your written policy.

You can ask employees to provide a copy of the jury summons and proof of service for your records. Planning for coverage in advance will help your operations run smoothly while the employee is away.

Voting Leave in Wisconsin

Wisconsin law requires you to provide up to 3 consecutive hours off for employees to vote while the polls are open, as long as they request the time off before Election Day. You must pay employees for this time off and may choose the specific hours that best fit your business needs.

You may not penalize or retaliate against employees for using voting leave. To avoid disruptions, you can remind staff of the request requirement and encourage early or absentee voting where possible.

Bereavement Leave in Wisconsin

Wisconsin does not mandate bereavement leave, so any time off for a death in the family is governed by your company policy. Many employers offer 1–5 days of paid or unpaid bereavement leave depending on the relationship to the deceased.

Clearly defining bereavement eligibility, duration, and pay status in your handbook helps set expectations and ensures consistent, compassionate treatment. You may also allow employees to use PTO or unpaid leave for additional time if needed.

Termination Process

Wisconsin is an at‑will employment state, so you or the employee may end the relationship at any time for any lawful reason, but you should still follow a documented, fair process. You should provide a final wage statement, pay all earned wages by the next regular payday, and comply with any written policies on PTO payout or severance.

Notice Period

Wisconsin law does not require individual employees to receive advance notice of termination, but larger employers may be covered by the federal WARN Act for mass layoffs or plant closings. Even when not required, giving reasonable notice or pay in lieu can reduce disputes and support smoother transitions.

Severance

Severance pay is not required under Wisconsin law, but you may offer it by contract or policy in exchange for a release of claims, subject to federal and state legal requirements. If you choose to provide severance, you should define eligibility, calculation methods, and payment timing in writing and apply the policy consistently.

How do you set up payroll processing in Wisconsin?

.png)

To set up payroll processing in Wisconsin, you first obtain a federal EIN, then register with the Wisconsin Department of Revenue for a withholding tax account and with the Wisconsin Department of Workforce Development for an unemployment insurance employer account. Next, you choose a pay frequency that meets Wisconsin’s requirement of paying at least monthly, implement a system to track hours and calculate taxes, collect Forms W‑4 and WT‑4 from employees, and establish a process to file and pay federal and Wisconsin payroll taxes on the schedules assigned to your business.

How does an Employer of Record help you hire in Wisconsin?

.png)

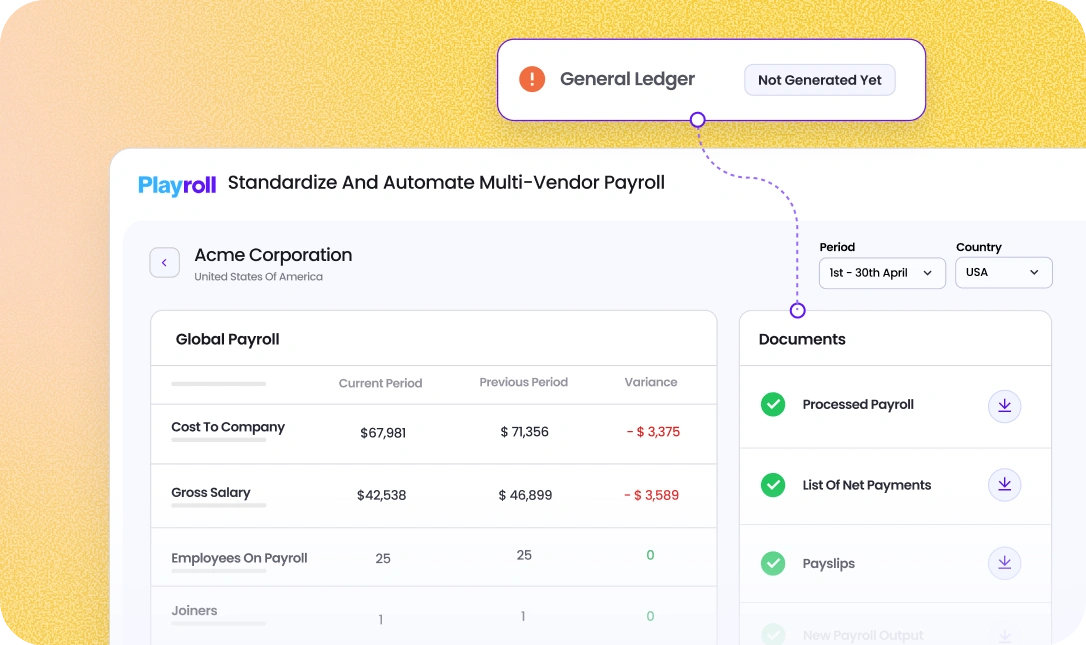

An Employer of Record helps you hire in Wisconsin by acting as the legal employer for state purposes, handling registrations, payroll, tax withholding, and required notices while you manage daily work. This lets you add Wisconsin employees quickly without opening a local entity, and reduces the risk of mistakes with Wisconsin wage, hour, and leave rules because the EOR maintains state‑specific compliance processes.

Is there a minimum wage requirement for employees in Wisconsin?

.png)

Yes, there is a minimum wage requirement for employees in Wisconsin, and it is currently $7.25 per hour for most nonexempt workers, matching the federal minimum. You must also ensure that tipped employees receive at least $7.25 per hour when you combine their cash wage and tips, and you should monitor any future changes at the state or federal level that could affect your pay practices.

How much does it cost to employ someone in Wisconsin?

.png)

The cost to employ someone in Wisconsin includes the employee’s gross wages plus employer payroll taxes such as Social Security, Medicare, federal and Wisconsin unemployment insurance, and the cost of any benefits you offer like health insurance or retirement contributions. You should also budget for workers’ compensation premiums, payroll processing fees, and indirect costs such as equipment and training to understand the true total cost of a Wisconsin hire.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)